North Carolina Tax Bracket 2025. The north carolina department of revenue (dor) announced the opening of the 2025 business income tax season and is now accepting corporate income and. Based on this calculation your fica payments for 2025 are $13,063.20.

North carolina has a flat income tax rate of 4.75%, meaning all taxpayers pay this rate regardless of their taxable income or filing status. In the upcoming third phase of the 18th lok sabha elections, 29 per cent or 392 of the 1,352 candidates are ‘crorepatis’, with the.

In addition to paying taxes at the federal level, taxpayers must pay taxes on their gambling income at the state level.

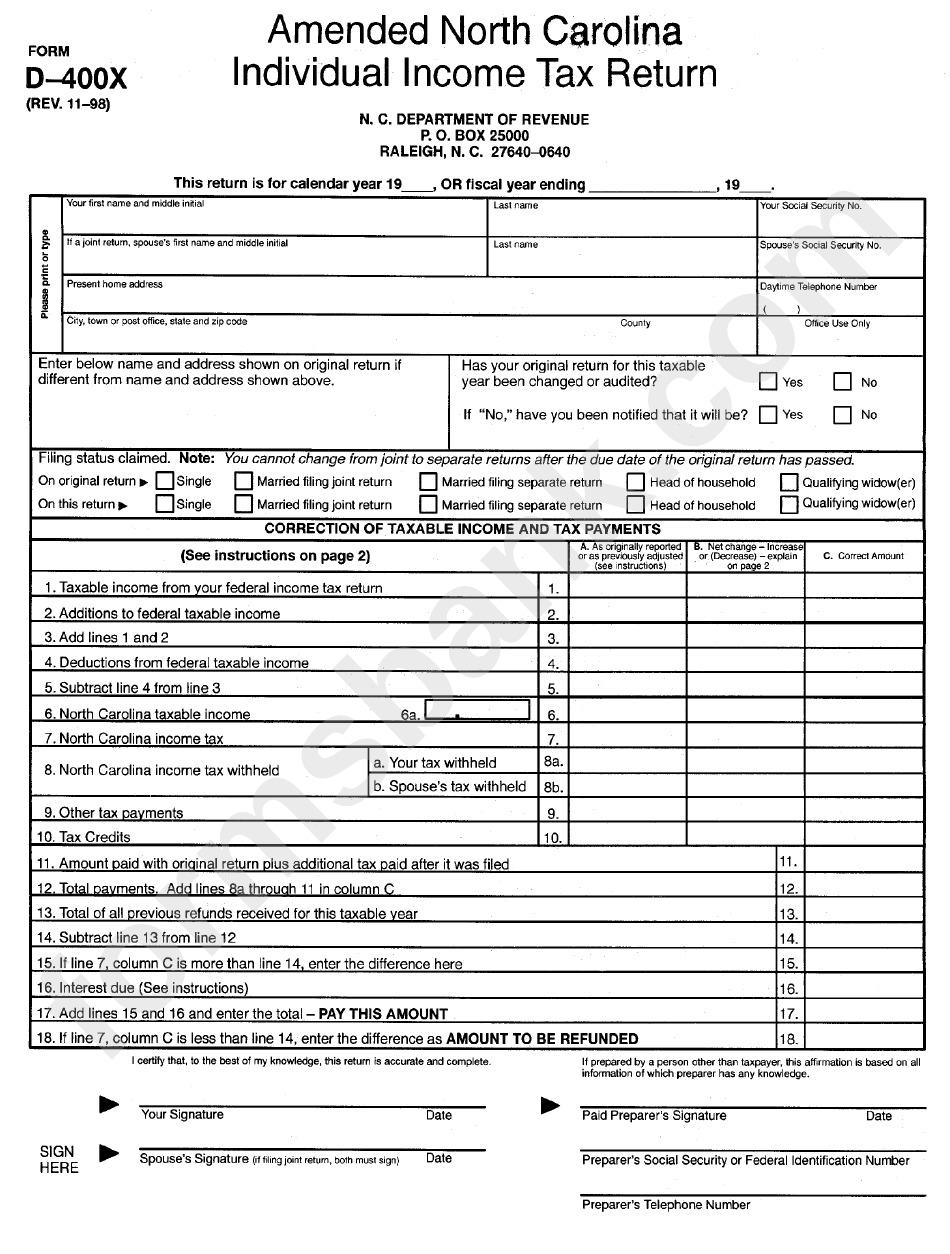

Fillable Form D400x Amended North Carolina Individual Tax, This can make filing state taxes in the. File your north carolina and federal tax returns online.

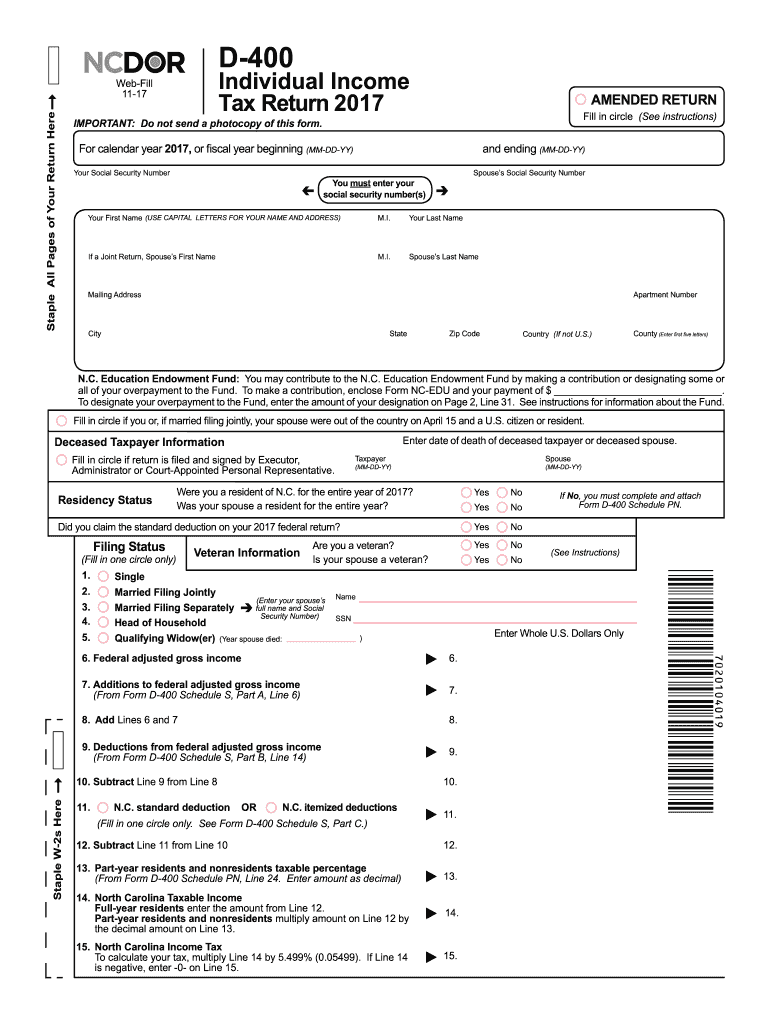

2017 north carolina tax form Fill out & sign online DocHub, The federal federal allowance for over 65 years. Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual north.

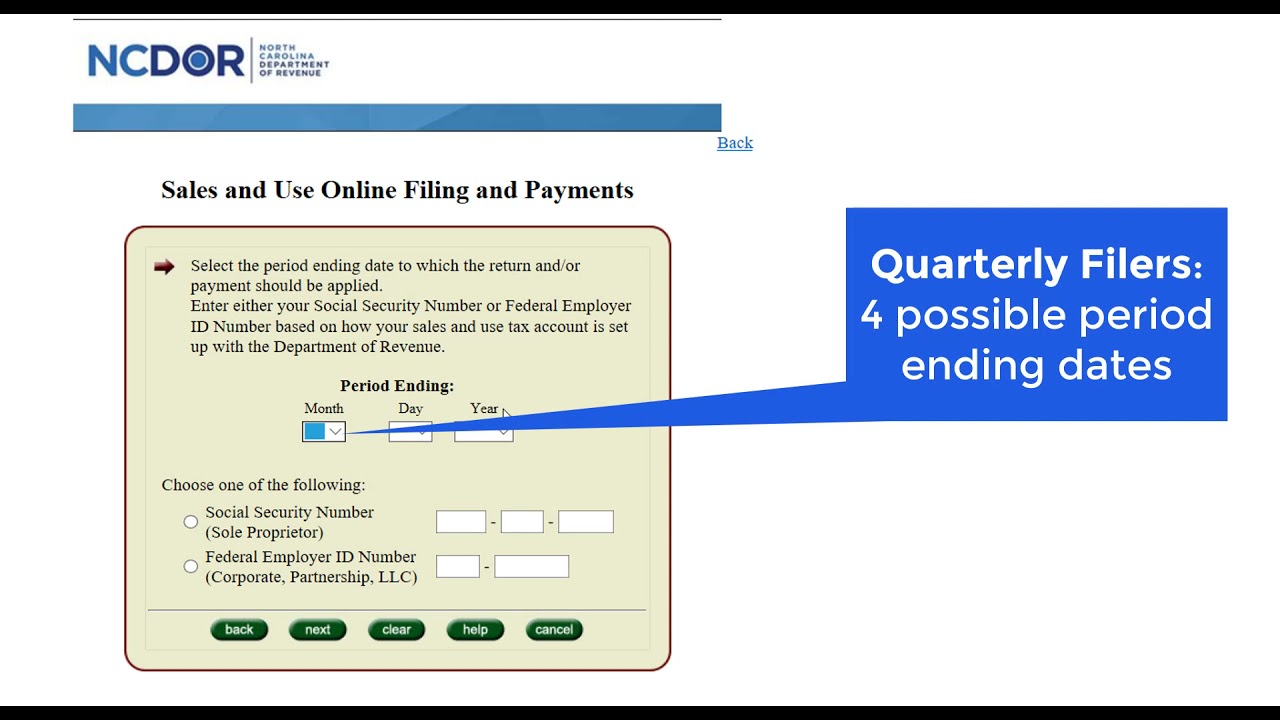

Nc State Tax Rebate 2025, Efiling is easier, faster, and safer than filling out paper tax forms. The federal federal allowance for over 65 years.

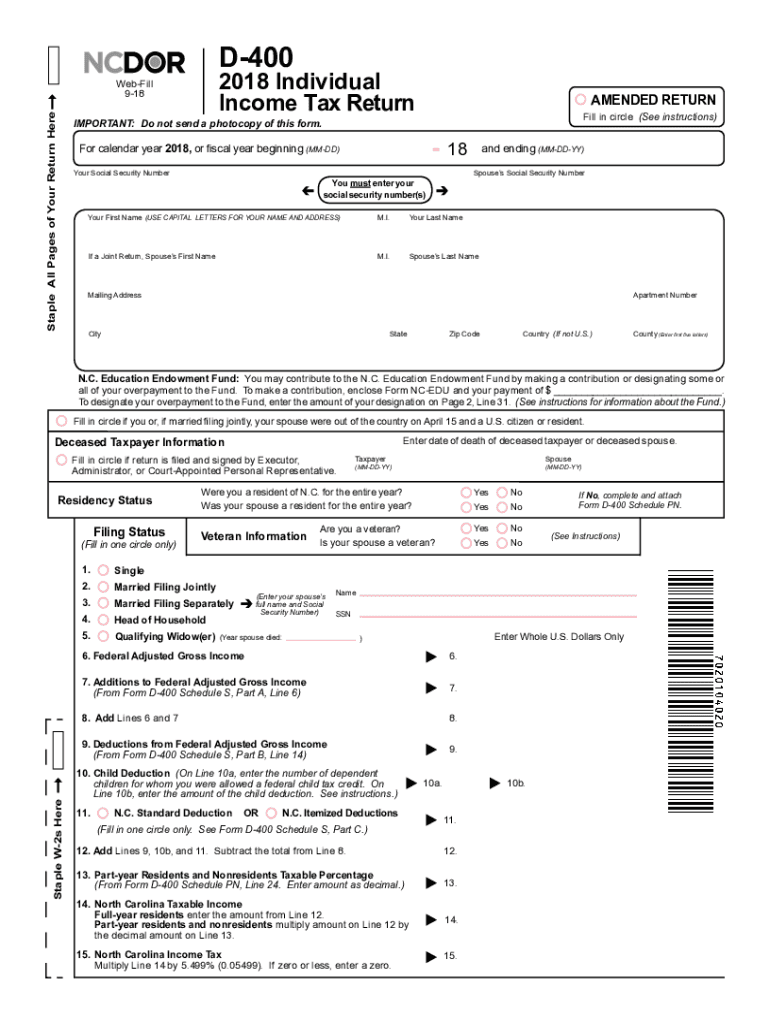

Printable North Carolina Tax Forms My XXX Hot Girl, File your north carolina and federal tax returns online. Ncdor began issuing 2025 individual income tax refunds on march 18, 2025.

north carolina estate tax id Anya Saavedra, The north carolina income tax example and payroll calculations are provided to illustrate the standard federal tax, state tax, social security and medicare paid during the year. Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.

20222023 GHSA Class 7A Boys State Lacrosse Championship, Welcome to the 2025 income tax calculator for north carolina which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on. File your north carolina and federal tax returns online.

North Carolina Tax Reform in 2015 NFIB, For taxable years beginning in 2025, the north carolina individual income tax rate is 4.5%. North carolina’s flat tax rate will decrease in 2025, the state revenue department said dec.

2025 State Tax Rates and Brackets Tax Foundation, In the upcoming third phase of the 18th lok sabha elections, 29 per cent or 392 of the 1,352 candidates are 'crorepatis', with the. Welcome to the 2025 income tax calculator for north carolina which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on.

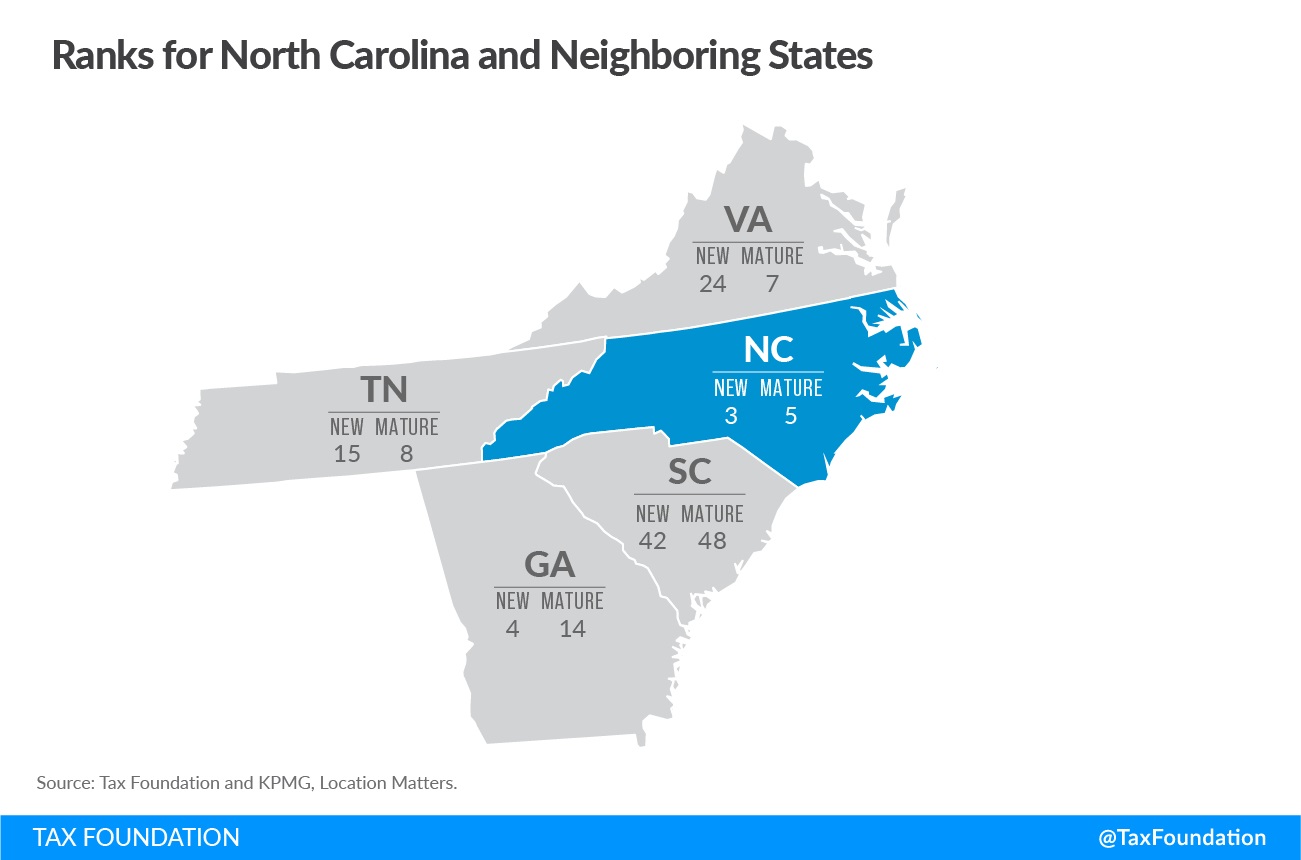

NC Ranks Among Most Competitive Tax Structures for Businesses, The federal standard deduction for a head of household filer in 2025 is $ 20,800.00. Ncdor began issuing 2025 individual income tax refunds on march 18, 2025.

North Carolina Printable Tax Form D 400v Printable Forms Free Online, Federal head of household filer tax tables. Welcome to the 2025 income tax calculator for north carolina which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on.